Malaysia Maldives Republic of Malta Mauritania Mauritius Mexico Moldova. Once the taxable value of the inheritance has been determined the amount of tax payable will depend on whether the appropriate tax free threshold has been exceeded.

Tax returns may be e-filed without applying for this loan.

. Inheritance tax estate tax and death tax or duty are the names given to various taxes that arise on the death of an individual. Fees for other optional products or product features may apply. However trusts are subject to three separate inheritance taxes.

What restrictions there are and whether making a will is advisable. Puerto Rico levies estate and gift taxes on the net taxable value. NA stands for Not Applicable ie.

Inheritance and gift tax rates Headline inheritance tax rate 10. The tax take from. Lane LLC from Harrisburg hes demanding over 500 u front before any work starts been scammed just rcently and very gun.

The Treasury raked in a record 61bn in inheritance tax last year as the Governments decision to freeze the threshold forced more grieving families to pay the death duty. This document shows how much you were paid during the tax year as well as the amount of income tax and. In many cases the trust may avoid one type of tax but will be caught by another.

Lets look at these in detail. And a ten-year charge. Any unused annual exemption may be carried forward for one tax year only.

The territory does not have the indicated tax or requirement. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year. Limited time offer at participating locations.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. A lot of people think that if you put your money in a trust it will be exempt from inheritance tax. Headline gift tax rate 30.

Attorney for deceased mother estate wants money upfront mispelled all info and his name comes up under different professions just being cautious please help been scamed twice before thia lost money as well. Malaysia which reflect a more tax-friendly policy choice. Up to the threshold amount 0 In excess of the Threshold Amount 33 As of 12102016.

HR Block Emerald Prepaid Mastercard is issued by MetaBank NA Member FDIC pursuant to license by. Youll also find the tax reference number on your P60 which employers give to each employee at the end of the tax year. The Global Property Guide looks at inheritance from two angles.

Please check a Mr Gregory M. While overall tax revenues have remained broadly constant the global trend shows trade taxes have been declining as a proportion of total revenues. Small gifts of up to 250 per donor per tax year.

HRB Maine License No. INHERITANCE TAX How high is income tax on residents in Puerto Rico. The tax reference number is usually shown on the payslip that you receive each time your employer pays your wages.

An annual exemption of up to 3000 in a tax year. Payments for family maintenance. 2021 HRB Tax Group Inc.

Normal expenditure out of income provided that it leaves the donor with sufficient income to maintain hisher normal standard of living. The rates of tax are as follows. Taxation and what inheritance laws apply to foreigners leaving property in Puerto Rico.

The tax is charged on the taxable value of the inheritance.

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Here S What You Need To Know About The Most Popular Estate Planning Trusts

How To Calculate Rpgt In 2020 For Sale Of An Inherited Property

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Can Lhdn Force Your Family Members To Pay Your Tax If Asklegal My

Scam Survivors Revjoiukmn Aol Com

Sale And Purchase Agreement In Malaysia 4 Important Clauses To Note

Citizenship By Investment In Malaysia Passports Io

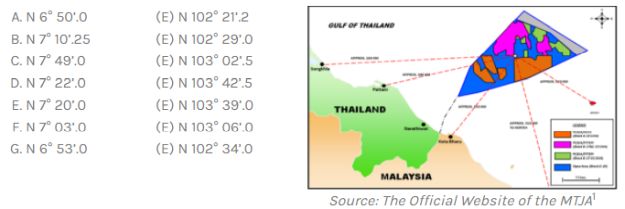

Companies Within Malaysia Thailand Joint Development Area Exempted From Service Tax On Certain Taxable Services From 1 May 2021 Tax Authorities Malaysia

Swiss To Vote On Federal Inheritance Tax Wsj

President S Tax Plan Would Kill Or Suppress Numerous Common Estate Tax Planning Techniques

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

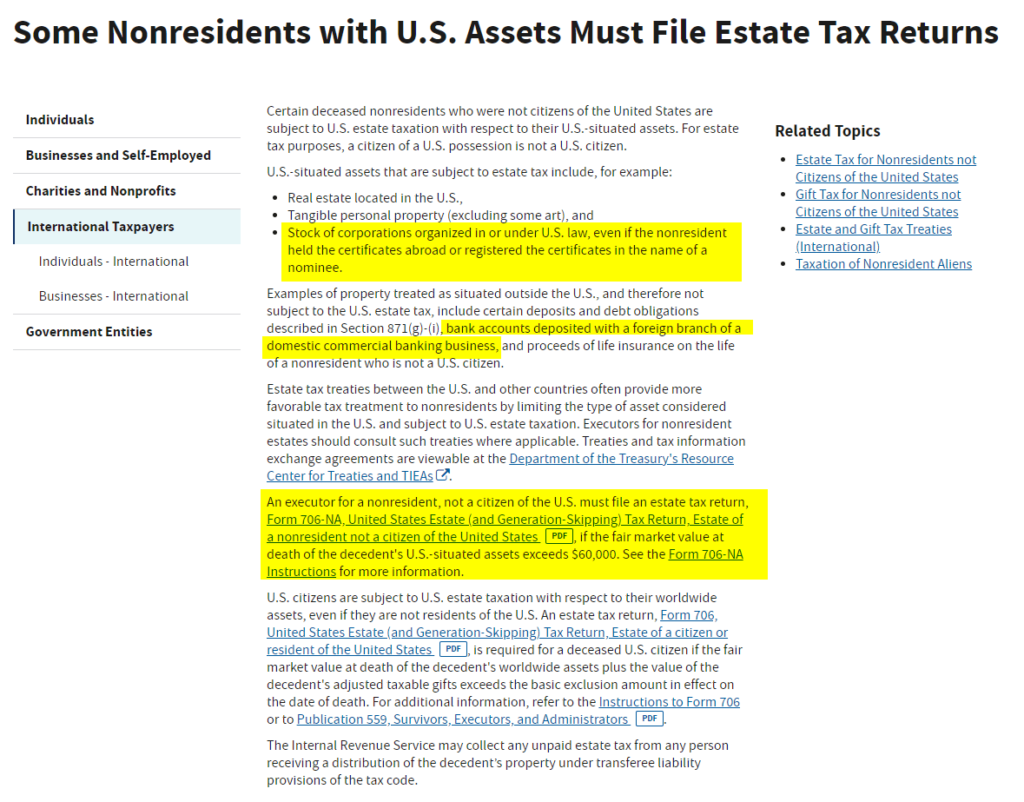

Implication Of Estate Tax And Withholding Tax On Us Situs Assets

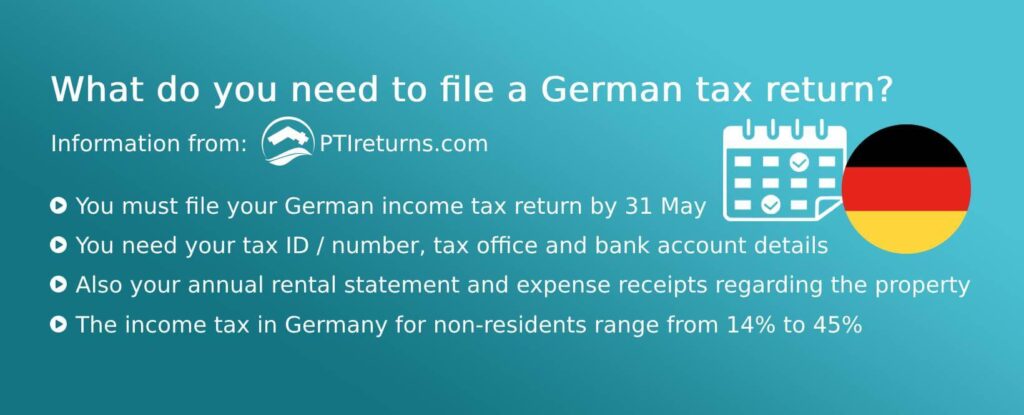

German Tax Advice For Smart Foreign Real Estate Investors Owners

Guide To Estate Taxes For Singaporean Investors With Overseas Investment Investment Moats